How can I increase my insurance sales using CPaaS software?

It’s never been easier for consumers to switch suppliers. Often, they’re moving not for a better plan but better customer service.

With the onset of the pandemic in 2020 and rapid changes in consumer preferences, it has become a challenging time for insurance providers to offer their service to customers. That’s because today consumers demand 24/7 support be delivered on their preferred channel of choice.

According to Gartner, statistics predict that around 85% of customer service interactions start with self-service. With those numbers, trends are showing that the leading industry incorporating video services is Insurance with 70% of insurance professionals planning to initiate video-enabled services for their clients.

And, for insurance types such as a vehicle, health, and home it’s important for insurance companies to strongly focus on improving customer service. But, how can established firms update their communication services to provide rich and instant service to consumers? We may have a few ideas!

Success in the insurance industry stems mainly from agencies building trust and convenience with clients. Many of the benefits CPaaS offers other industries like in-app video calling, instant messaging, file sharing, can help insurance agents connect with their clients.

Communications Platform as a Service (CPaaS) offers an innovative, flexible, and scalable solution to customers by helping insurance companies take the company to the next level. Improve the customer and agent experience, automate the process, streamline the processes – claim, which in turn strengthens the customer experience and increases loyalty.

CPaaS offers solutions to businesses that are the most pressing issues for a few industries like – finance, insurance, healthcare, etc. Firstly, it allows customers and agents to stay in touch with each other to meet customer needs. Second, in a time when companies are forced to trim their bottom line (that has seen more during COVID), CPaaS brings efficiency and cost-saving by supporting sales and improving the customer experience.

Here are a few things where CPaaS offers a lot of opportunities for insurance agents like you, bringing in additional and ongoing revenue outside the traditional cold calls, and network sales.

Grow your client base and create more engaged relationships.

Post-Covid, customer expectations have transformed nearly every industry, but despite the pressure, some insurance providers are still clinging to their traditional methods for communications. Customers want to connect with their insurance agents on their preferred channel other than just by phone. By incorporating CPaaS for insurance, you can introduce new ways of communicating with your customers and track the development of new applications to attract customers and stick them to you through SMS, email, social media, and more.

There is a fact that says 98% of SMS messages get opened within 3 minutes of the delivery. Can you say how many network sales or phone calls can say that?

Here are a few ways how you can use CPaaS to engage with your clients and boost loyalty:

- Send out automated SMS messages to customers alerting them about their policy renewal or ending dates.

- Send pop-up notifications for the new policies introduced and keep your customers engaged

- Enhance customer loyalty by sending them tips on how to keep their homes safe, cars running in the top model, and wellness advice.

- Ensure to send customers their birthday wishes, festival wishes, anniversaries to make your customers feel that you care for them!

- Proactively reach out to customers who’ve disconnected the call while speaking with an agent to improve sales.

- Enhance the transparency to offer a trouble-free claim process

- Rectify problems of customers with explainability, using features like video calling, instant messaging, and chat support.

Provide timely communications and offer consistent customer support

The sale of any business increases with greater customer satisfaction. Around, 40% of customers decide their insurer based on the level of satisfaction the customer gets when interacting with an agent.

While there are many touchpoints between customers, agents, and third parties, providing excellent customer service starts with customer support.

Imagine a situation that happens daily in the insurance industry: a claim. For instance, let’s suppose a customer has recently suffered some sort of damage to their home/ vehicle, takes a video of the damage from their device, and claims purposes. This data is captured from the agent’s app and viewed on the other end by a claim’s agent (click-to-call video conferencing), Since the app allows an agent to see the damage and includes geo-targeting data, the agent doesn’t need to visit the customer’s premise to initiate the next steps of the claim process.

From there customer receives an automated message regarding the update of the claim process going through various levels. On the other end, the insurance company uses CPaaS solutions in various forms of communication to deploy information through chat, phone, and, email.

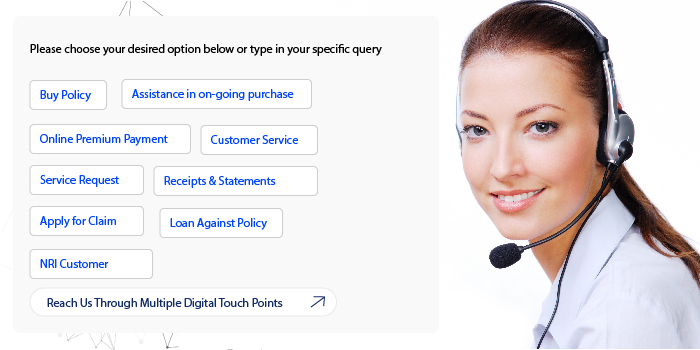

You can also provide customer support by creating self-service options like automated calls or text-in options or chat that lets customer solve their basic inquiries at their convenience. For example, customer can check their claim status, get answers to FAQs, and live agent support.

This way you can cut the administrative bloat, enhance transparency, improve the customer experience, and benefit both claim agents and customers.

Enhance internal communications

Customer communication is probably an important thing in any business, but what is often overlooked and equally important to agency success is the communication between your employees. With the help of CPaaS, improve your internal communications by sending automated notifications about weather closures, change in policies, update on new schemes or any other important updates.

You can even extract information of your employees’ special days from your HR management system to send birthday wishes, service anniversaries to show employees your appreciation. You can even gather feedback from your employees using survey forms, polls, or can interact with your employees on multiple channels.

Unlike other software, CPaaS is built for non-technical users. Its flexibility and scalability make it easier and more useful anywhere enhanced. Any industry with weakness in its communication structure can benefit from CPaaS enhanced tools and techniques, creating more effective communication with employees, customers and

It’s never been easier for consumers to switch suppliers. Often, they’re moving not for a better plan but better customer service.

With the onset of the pandemic in 2020 and rapid changes in consumer preferences, it has become a challenging time for insurance providers to offer their service to customers. That’s because today consumers demand 24/7 support be delivered on their preferred channel of choice.

According to Gartner, statistics predict that around 85% of customer service interactions start with self-service. With those numbers, trends are showing that the leading industry incorporating video services is Insurance with 70% of insurance professionals planning to initiate video-enabled services for their clients.

And, for insurance types such as a vehicle, health, and home it’s important for insurance companies to strongly focus on improving customer service. But, how can established firms update their communication services to provide rich and instant service to consumers? We may have a few ideas!

Success in the insurance industry stems mainly from agencies building trust and convenience with clients. Many of the benefits CPaaS offers other industries like in-app video calling, instant messaging, file sharing, can help insurance agents connect with their clients.

Communications Platform as a Service (CPaaS) offers an innovative, flexible, and scalable solution to customers by helping insurance companies take the company to the next level. Improve the customer and agent experience, automate the process, streamline the processes – claim, which in turn strengthens the customer experience and increases loyalty.

CPaaS offers solutions to businesses that are the most pressing issues for a few industries like – finance, insurance, healthcare, etc. Firstly, it allows customers and agents to stay in touch with each other to meet customer needs. Second, in a time when companies are forced to trim their bottom line (that has seen more during COVID), CPaaS brings efficiency and cost-saving by supporting sales and improving the customer experience.

Here are a few things where CPaaS offers a lot of opportunities for insurance agents like you, bringing in additional and ongoing revenue outside the traditional cold calls, and network sales.

Grow your client base and create more engaged relationships.

Post-Covid, customer expectations have transformed nearly every industry, but despite the pressure, some insurance providers are still clinging to their traditional methods for communications. Customers want to connect with their insurance agents on their preferred channel other than just by phone. By incorporating CPaaS for insurance, you can introduce new ways of communicating with your customers and track the development of new applications to attract customers and stick them to you through SMS, email, social media, and more.

There is a fact that says 98% of SMS messages get opened within 3 minutes of the delivery. Can you say how many network sales or phone calls can say that?

Here are a few ways how you can use CPaaS to engage with your clients and boost loyalty:

- Send out automated SMS messages to customers alerting them about their policy renewal or ending dates.

- Send pop-up notifications for the new policies introduced and keep your customers engaged

- Enhance customer loyalty by sending them tips on how to keep their homes safe, cars running in the top model, and wellness advice.

- Ensure to send customers their birthday wishes, festival wishes, anniversaries to make your customers feel that you care for them!

- Proactively reach out to customers who’ve disconnected the call while speaking with an agent to improve sales.

- Enhance the transparency to offer a trouble-free claim process

- Rectify problems of customers with explainability, using features like video calling, instant messaging, and chat support.

Provide timely communications and offer consistent customer support

The sale of any business increases with greater customer satisfaction. Around, 40% of customers decide their insurer based on the level of satisfaction the customer gets when interacting with an agent.

While there are many touchpoints between customers, agents, and third parties, providing excellent customer service starts with customer support.

Imagine a situation that happens daily in the insurance industry: a claim. For instance, let’s suppose a customer has recently suffered some sort of damage to their home/ vehicle, takes a video of the damage from their device, and claims purposes. This data is captured from the agent’s app and viewed on the other end by a claim’s agent (click-to-call video conferencing), Since the app allows an agent to see the damage and includes geo-targeting data, the agent doesn’t need to visit the customer’s premise to initiate the next steps of the claim process.

From there customer receives an automated message regarding the update of the claim process going through various levels. On the other end, the insurance company uses CPaaS solutions in various forms of communication to deploy information through chat, phone, and, email.

You can also provide customer support by creating self-service options like automated calls or text-in options or chat that lets customer solve their basic inquiries at their convenience. For example, customer can check their claim status, get answers to FAQs, and live agent support.

This way you can cut the administrative bloat, enhance transparency, improve the customer experience, and benefit both claim agents and customers.

Enhance internal communications

Customer communication is probably an important thing in any business, but what is often overlooked and equally important to agency success is the communication between your employees. With the help of CPaaS, improve your internal communications by sending automated notifications about weather closures, change in policies, update on new schemes or any other important updates.

You can even extract information of your employees’ special days from your HR management system to send birthday wishes, service anniversaries to show employees your appreciation. You can even gather feedback from your employees using survey forms, polls, or can interact with your employees on multiple channels.

Unlike other software, CPaaS is built for non-technical users. Its flexibility and scalability make it easier and more useful anywhere enhanced. Any industry with weakness in its communication structure can benefit from CPaaS enhanced tools and techniques, creating more effective communication with employees, customers and increasing sales.

increasing sales.